Omron White Paper – Traceability

By Laura Studwell, Omron Automation And Safety

Food Safety British Retail Consortium food safety Food Safety Modernization Act FSSC 22000 Global Food Safety Initiative International Featured Standards Omron Automation and Safety Safe Quality Food Institute TracebilityVision inspection is vital for brand protection - and Omron's White Paper tells you why.

High consumer expectations regarding food safety as well as new legal requirements mean that food and beverage processing and packaging companies have a growing need for vision systems that check whether information on a package or label has been applied correctly according to defined consumer information.

Companies are increasingly using vision systems as a critical component of their traceability and record-keeping protocols. This whitepaper outlines new industry regulations, the impact of traceability and record-keeping on the supply chain and the use of vision systems to minimize product liability.

Driven by a myriad of high-profile laws, acts, directives and regulations, traceability is a hot topic for food and beverage processing and packaging companies.

Without fine-tuned traceability protocols, consumers are exposed to defective products and companies are faced with the possibility of recalling large quantities of product without certainty of compromised integrity. Both scenarios have enormous implications with the core issue being visibility into factors affecting product, packaging or labeling quality.

Traceability protocols minimize disruptions, such as product recalls, which come at an immediate cost and often result in a loss of future sales and significant long-term brand damage.

Companies that process, package, transport or hold food and beverage products must contain potential integrity problems before the product leaves the plant while at the same time sharing detailed product genealogy with their supply chain. In this increasingly complex, industrialized and global market, companies are seeing the need to add traceability protocols to their food safety and quality management system. And they are demanding the same throughout their supply chain, from raw material input suppliers to contract packaging plants and distribution centers.

Traceability protocols are added to a food safety and quality management system to achieve two primary goals:

- Eliminate recalls by providing real-time data on all supplier materials, machinery, operators and processes involved in producing the defective product before it reaches the market.

- Minimize the number of products that are recalled when an issue is found by identifying only the specific product codes that were built with a faulty input or that followed a faulty process.

Improved food safety and quality management through traceability – an element of the Hazard Analysis Critical Control Point (HACCP) method supported by new regulations – will ultimately reduce risks and costs associated with product contamination and poor product integrity.

Traceability is most effectively managed through vision inspection. This technology ensures information contained on the package or the label matches the product content, is legible and integral – key components of traceability. Sharing of this vital information throughout the supply chain is best facilitated by transferring data to a secure database, in accordance with regulatory guidelines for record-keeping.

THE DRIVING FORCE BEHIND NEW INDUSTRY REGULATIONS

According to the Centers for Disease Control, one in six Americans are affected by food-borne illness each year. The Public Health Agency of Canada estimates that one in eight Canadians are affected each year. Both agencies state that illness can stem from either contaminated products or allergies relating to mislabeled products. This is a significant public health burden that, with proper protocols, can be prevented before products reach the market.

Recently, a well-known producer of specialty foods issued a large product recall. The primary packaging was mislabeled, displaying incorrect product content. While the food did not contain a food-borne illness, it was produced on a line that contained nuts, a common allergen. Consumers with known food allergies put trust in producers to ensure packaging and labels match the product contents.

The company failed to perform due diligence in accordance to a HACCP plan. A quality check, using a vision system, at the end of the first packaging run could have prevented the entire recall – and over 60,000 packages entering the market.

The impact of recalling a product is tremendous. According to a study by the Washington Times, $7 billion is spent annually on product recall issues. The short- and long-term costs of a recall can be significant and are influenced by many factors. Some costs are directly related to recall activities, such as the investigation of the fault, customer notification of the recall, transportation of the recalled product, machinery repair costs and loss in value of the defective product.

Other costs are indirectly associated with a product recall, including loss of sales due to negative publicity. IBM Consulting reports that 57% of consumers stop purchasing a brand when associated with a recall. A product recall can have a dramatic effect on the brand, market share and ultimately profitability.

UNDERSTANDING THE CONTINUOUS CAUSE OF PRODUCT RECALLS

Product recalls cover a broad spectrum from serious health and safety risks to misrepresentation of product performance or composition. Causes of recalls stem from a wide-variety of issues, including material tampering, false marketing claims, inadequate shelf life, inaccurate food-preparation instructions, cross-contamination, inadequate plant safety protocols and improper packaging or labeling.

Food Quality & Safety Magazine asserts the number one cause of product recalls is incorrect packaging, labeling and other food safety markings.

An example of how quickly a company can realize payback on their investment in traceability comes from a salmonella outbreak at a pistachio processor. The FDA found that the pistachios were contaminated when roasted product mingled with raw product. The company could not determine where the lines ran together and which lots were the problem and therefore had to recall its entire crop. The Acheson Group, a consulting firm for the food and beverage industry, reported the company was penalized for poor and inconsistent markings on their packaging. Traceability protocols and good record-keeping would have saved the company millions of dollars in product recall costs as well as the loss of consumer confidence that resulted from the widely-publicized incident.

While most product recalls stem from incorrect packaging, labeling and other food safety markings, there is another source that is not as frequently taken into consideration – the consumer. In today’s connected world, consumers are more educated and understand the label and any claims it makes must match what is in the product. Consumers now demand more information on the composition, origin and handling of the food they eat. While dietary restrictions, such as nut allergies, are safety issues, other areas that can cause issues relate to personal preferences such as gluten-free, zero trans-fat and genetically modified ingredients. The failure to comply with consumer demands might not bring government action, but it can result in lawsuits and irrevocable, bad publicity – all of which make consumers wary.

PRODUCT SAFETY COMPLIANCE AS A DEFENSE TO PRODUCT LIABILITY

Companies can no longer rely on purely reactive strategies to product safety. New industry regulations are pushing companies to incorporate traceability protocols in their HACCP plans – to proactively identify potential risks and ensure product safety and integrity.

As mentioned earlier, there are a number of laws, acts, directives and regulations that were developed to support product safety and compliance effectiveness. These initiatives have spread beyond traditional borders making the supply chain more complex and diverse. They have garnered attention from international communities, who are working together to establish regulatory governance that will ensure safety and compliance.

These initiatives will impact the level of investment processing and packaging companies need to make in order to meet compliance standards. According to the Packaging Machinery Manufacturers Institute (PMMI), traceability and recordkeeping are expected to represent one of the greatest costs of compliance with the Food Safety Modernization Act (FSMA). This will generate an opportunity for the original equipment manufacturer (OEM) to present systems and solutions which anticipate and satisfy the challenges companies will face in the upcoming years.

FOOD SAFETY MODERNIZATION ACT

The law that will have the most effect on stakeholders throughout the supply chain is the Food Safety Modernization Act (FSMA). The FSMA aims to ensure better food safety by shifting focus from reacting to contamination or product integrity incidents to preventing them.

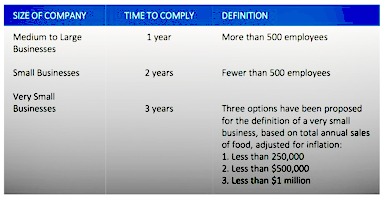

Although the law went into effect in 2011, final rules pertaining to food for human consumption will be published in 2016 and will provide for a period of time before compliance is enforced by the Food and Drug Administration (FDA). The chart below illustrates the time frame in which companies will need to have a proper traceability and record-keeping system in place.

FSMA requirements will be performance-based, which means the FDA will not set specific rules for food safety. Requirements will focus on the performance, or outcomes, which processing and packaging companies are required to achieve. This gives companies latitude in how they choose to meet the requirements. Again, this provides OEMs with an opportunity to play a major role by looking at the overall equipment effectiveness (OEE) of existing systems and determining if companies either need to install new systems or modify legacy systems.

The three aspects of the FSMA that will impact food and beverage processing and packaging companies, and subsequently OEMs, are:

- Preventative control

- Traceability and record-keeping

- Sanitary equipment design

There are several industry segments that fall under the food and beverage umbrella that will not be affected, simply because they are outside of the FDA’s regulatory framework. Meat, poultry and egg products are exempt as they are regulated by the USDA. Juice, low-acid canned foods and seafood are also exempt because they already have similar, acceptable controls in place.

With FSMA laws focusing on performance achievement companies will turn to industry standards, such as the Global Food Safety Initiative (GFSI) – which provides prescriptive requirements – to assist with compliance. Guidelines derived from GFSI-accepted standards will become equally important to OEMs as they are to processing and packaging companies, as both need to understand how the standards will address FSMA regulations.

GLOBAL FOOD SAFETY INITIATIVE

The Global Food Safety Initiative is a collaboration between the world’s leading food safety experts – their standards are accepted worldwide. GFSI uses the HACCP method to ensure food safety, typically requiring companies to perform a thorough review and analysis of production processes. Companies are tasked with identifying Critical Control Points (CCPs) where products can become contaminated or integrity can become compromised. The analysis addresses FSMA food safety requirements by looking at three areas:

- Determining safe levels of the fault

- Designing monitoring processes to keep faults below the safe levels

- Keeping records to show faults are kept below minimum safe levels

There are four GFSI-accepted food safety standards:

- British Retail Consortium (BRC)

- International Featured Standards (IFS PACsecure)

- Safe Quality Food Institute (SQF)

- FSSC 22000 (Based on ISO 22000)

There are over 50,000 companies that process, package, transport or hold food and beverage products who are certified according to a GFSI-accepted standard including Cargill, Coca Cola, CostCo, Hormel, International Paper, Kraft, Safeway, Target, Tyson Foods and Wal-Mart.

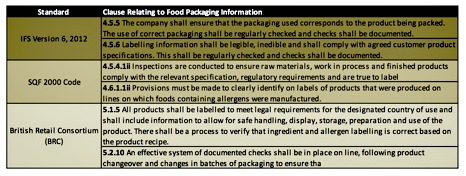

Any of the four GFSI-accepted standards offer prescriptive requirements pertaining to traceability and record-keeping that satisfy FSMA regulations. The following chart briefly covers clauses in the standards related to packaging.

For traceability compliance, GFSI-accepted standards like IFS (4.12.3), take packaging clauses a step further and outline prescriptive requirements recommending companies implement inspection systems, where required, in the production process and undergo regular maintenance to avoid malfunction. It also states that potentially contaminated products must be isolated at the earliest point possible in the production process.

An example of how IFS (2.1.2.1) addresses record-keeping is by stating all relevant records necessary for the product requirements shall be complete, detailed, maintained and shall be available on request. FSMA states all records must be kept for a minimum of two years.

TRACEABILITY IN THE SUPPLY CHAIN

Traceability is the capability to link the physical flow of products with the flow of information about them. There are two ways traceability can be applied within the supply chain, both of which must meet FSMA requirements. To be a holistic effort, traceability protocols need to follow the same prescriptive requirements.

- External traceability implies all traceable components must be uniquely identified and the information shared between all parties in the supply chain. Unique product identifiers must be communicated to the supply chain via product labels and related electronic documents. This links the physical products with the information necessary for traceability.

- Internal traceability implies that processes must be maintained within a company to link identities of raw material inputs to those of finished goods. When a material is combined with others and then processed, reconfigured or repacked, the new product must have its own unique product identifier. The linkage between the new product and the original material inputs be maintained for traceability. This principle applies to any product that is part of a larger packaging hierarchy such as cases or pallets.

FSMA requires a one-step-forward-one-step-backward approach to traceability. Companies must be able to identify the businesses to which their products have been supplied and to trace raw material inputs back to the immediate supplier.

BENEFITS OF TRACEABILITY BEYOND COMPLIANCE

OEMs need to play a major role when it comes to helping companies meet FSMA traceability requirements because existing systems vary widely in sophistication. Some companies have robust systems, mainly due to retailer-mandated codes of practice. However, some processing and packaging companies still use paper-based systems. Overall, a vast majority of companies have some form of a traceability system in place but the dynamics vary depending on the amount of information the system records, how far forward or backward in the supply chain the system tracks, technologies used to maintain records and the precision with which a system can pinpoint a product’s movement.

Companies without robust systems need to upgrade because their current systems will not meet FSMA performance standards. While compliance remains the primary concern, a robust traceability system offers benefits beyond FSMA compliance:

- Reduced liability by showing precisely which supplier shipments were received and where the raw material inputs were incorporated into processing, reducing exposure to product recalls.

- Reduced waste from when product recalls do occur. Traceability systems will tell the company which products are affected, allowing them to recall specific batches instead of entire lots.

- Identification of contaminated products or products with compromised integrity before they reach the market, protecting the brand and maintaining consumer confidence.

- Higher quality raw material inputs realized by forced traceability throughout the supply chain.

- Increased customer satisfaction due to the provision of more information on the composition, origin and handling of products.

RECORD-KEEPING AS A FORM OF RISK MANAGEMENT

Maintaining records of supply chain activities is vital to a food safety and quality management system. Records provide documentation that appropriate preventative actions, or in some cases corrective actions, were taken when safe levels were threatened.

In the event a company is implicated in a product recall, records of activities can provide proof that reasonable care was exercised during operations. Record-keeping provides a mechanism for verifying the activities outlined in a HACCP plan were properly executed. In many cases, records can serve a dual purpose of ensuring safety and food quality – while avoiding risk.

FSMA requires that a company keep relevant records necessary for product requirements. The following record types are regarded as critical to support an effective food safety and quality management system:

- Hazard analysis

- Preventative controls

- Monitoring

- Corrective actions

- Verification and validation

- Foreign supplier verification

FSMA does not require companies to keep electronic records. However, GFSI-accepted standards prescribe electronic implementation in their standards.

Electronic records are the most effective way to disseminate critical information throughout the supply chain. The FSMA does recognize that electronic record-keeping vastly improves traceability in the supply chain.

GOOD RECORDKEEPING PRACTICES

FSMA follows the HACCP method, which is a well-recognized preventative program designed to identify and mitigate product safety risks. It requires excellent record-keeping practices and thorough documentation.

The Safe Quality Food Institute (SQF) recommends the following practices for good recordkeeping:

- If an activity has an impact on food safety, it should be recorded.

- The frequency of recorded events should be related to food safety and process stability. Be prepared to consider any product – from the time of an ‘out-of-limits’ event back to the last acceptable check – as unacceptable. For example, if temperature is checked once per hour, all production for up to one hour could be suspect if the process is discovered to be out-of-limits.

- Records are to be noted electronically at the time of the event, by the person conducting the activity.

- Each recorded activity should include either affirmative or negative results, accompanied by the signature of the person who completed the action. Do not just record non-compliance, record evidence of compliance as well.

- Following a corrective action, always document a return to appropriate conditions. For example, documentation of unacceptable sanitation should be followed by documentation of re-cleaning and re- inspection, including the results of that inspection.

These steps will help ensure communication, which leads to factual decisions and decreases the risk and cost associated with product contamination or poor product integrity. Companies must be prepared to share records of product status to remove doubt wherever possible.

CRITICAL FOOD SAFETY INFORMATION ON PACKAGING AND LABELS

Part of traceability and recordkeeping is ensuring the information contained on the package or the label matches the product content. Product information must be collected, recorded and shared to ensure at least one-step- forward-one-step-backward traceability.

To implement a solution, such as a vision system, that will mitigate the risk associated with improper packaging or labeling, it is important to understand the criteria that consumers use to make purchasing decisions:

- Allergen content

- Best-before date

- Storage conditions

- Instructions for use

There is a second, but equally important, use of markings for maintaining food safety and it is often associated with internal traceability. During processing, before the final product leaves the facility, there are many opportunities where contamination can occur. The earlier contamination can be detected, the less likely the compromised product is to spread throughout the supply chain, such as to distribution. In order to ensure complete withdrawal of a product before it reaches the market, any member of the supply chain must be able to read the following information:

- Product name or number (unique product identifier)

- Best-before date, production date, lot or batch number

- Producer name and address

- TRACEABILITY LABELING TECHNOLOGY

There are several technologies that assist in applying identification to products for traceability purposes. Processing and packaging companies need to keep in mind that traceability is only as strong as the weakest link in the supply chain. The most widely-used technologies are:Barcodes - 2D matrix codes

- Radio-frequency identification tags (RFID)

Traceability is technology-driven and varies depending on a product’s position in the supply chain – from packaging and logistics to storage, handling and retail.

Companies should be aware of newer technologies, including GPS, infrared and biometric. These technologies have different applications across various stages of movement. For example, GPS is often used for food involving the movement of live feedstock.

Barcodes are still the most common form of labeling technology. However, RFID tags are gaining popularity because they can store a wide-range of information and will integrate well with GPS technology, which serves the entirety of the supply chain.

VISION INSPECTION FOR COMPLETE PRODUCT INTEGRITY

High consumer expectations regarding information on products as well as new legal requirements, mean that companies have a growing need for vision systems that check whether information has been applied correctly according to defined consumer information.

Companies are incorporating vision systems at CCPs throughout processing and packaging. A vision system will reliably check packaging and labeling at high speeds, ensuring printed information is present, legible and accurate.

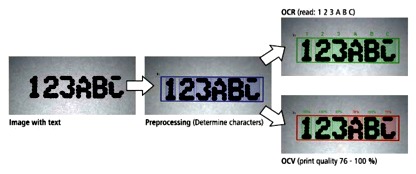

There are two common methods for verifying characters read by a vision system:

- Optical character recognition (OCR)

- Optical character verification (OCV)

OCR is used when the print and characters vary by product or by printed marking. It is the method of choice in the food and beverage industry, where content is important. OCV ascertains the print quality of a label by comparing it against a reference image.

Vision systems play an integral role helping companies meet the prescriptive requirements of GFSI-accepted standards – as inspection is required and often in conjunction with a fail-safe reject mechanism.

Vision systems play an integral role helping companies meet the prescriptive requirements of GFSI-accepted standards – as inspection is required and often in conjunction with a fail-safe reject mechanism.

While food safety is the biggest concern in the industry, a vision system provides substantial cost savings as well as brand protection when it comes to non-conforming products. Non-conforming products incur additional costs because they need to be repackaged which requires additional labor, material and machinery costs.

If non-conforming products reach the retailer, a company can incur fines, special discounts or even perform a complete recall of the product. The higher the speed of the production line, the more quickly non-conforming products can be produced without being detected. A vision system detects defective products in real-time and can immediately stop further production saving additional cost and valuable time.

The cost of one fine, one special discount, or product recall can easily exceed the initial investment of a vision system. By avoiding a food safety incident, a company builds retailer confidence in the brand. Subsequently, by ensuring food safety markings always meet brand quality standards, the retailer can aid in cultivating consumer satisfaction and loyalty.

GUIDELINES FOR CHOOSING THE RIGHT VISION SYSTEM

FSMA and GFSI are driving technical advancements in vision capabilities. Technology developers are under increasing scrutiny to interpret regulations and supply future-proof solutions that can withstand amendments to regulations. Vision systems now offer a myriad of features that extend past regulations and traditional boundaries.

Here are a few things companies should consider when evaluating an automated vision system:

- Partner Knowledge – Work with a provider that understands regulations affecting your industry and your market. If you do not select the correct vision system in the beginning, you will find yourself investing more time and expense than you anticipated while trying to conform the system to your expectations.

- Know Your OEE – Select a company that will calculate the OEE of your existing system and provide a new system that will help you remove any existing constraints and point you in the direction of improvement.

- Overall Compatibility – Confirm compatibility with existing equipment on your production line, such as horizontal flow wrappers. You should also confirm compatibility with your processes, as both equipment and processes work hand-in-hand to ensure compliance.

- Integrated Solution – A high-functioning integrated solution should match your minimum application and run-time needs. Select a solution that includes core capabilities such as vision, software and network communications and can offer synchronous control of all your machine network devices.

- System Speed – Select a system that can process data according to the optimum running speed on your production line. A vision system should add value to your food safety initiatives, having a positive impact on output and profits.

- Data Integration – Make sure the vision system is well-integrated with your control system on the plant floor; and your control system is well-integrated with your enterprise-level system for data storage and analytics, enabling good traceability and record-keeping practices.

BEST PRACTICES FOR COMPLYING WITH FSMA

PMMI offers three recommendations to help companies comply with FSMA requirements:

1. Study FSMA’s HACCP method to fully understand the needs of each industry segment that falls under the food and beverage umbrella. Leverage this understanding to procure equipment and services that address your needs directly.

2. Incorporate FSMA requirements into your company’s HACCP plan and overall corporate strategy.

- When considering advanced traceability and record-keeping systems, focus on how pen-and- paper systems are labor intensive, prone to inaccuracies and compromise relationships with electronic-based customers and suppliers. Note they are cumbersome to work with especially when there is a contamination or product integrity issue.

- Consider equipment upgrades and additional services as a way to minimize food safety risks, but also as a way to positively position and market your company.

- Evaluate whether to install new systems or modify legacy systems and which alternative will help you better meet new FSMA requirements as well as anticipate future amendments.

- Integrate equipment that is easy to disassemble, sanitize and keep clean throughout each production run.

3. Take advantage of enhanced services offered by your partners such as training options for operators. Try to embed education as a core part of your HACCP

plan.

THE PROLIFERATION OF TRACEABILITY

According to Food Production, the worldwide proliferation of technology that facilitates traceability is expected to reach $14B in sales by 2020.

Allied Market Research states that traceability protocols are becoming more common in HACCP plans due to consumer demands and government regulations. Today, vision systems are gaining momentum when it comes to supporting traceability initiatives and sales are anticipated to rise significantly in the next five years.

This opens the door for OEMs to present systems and solutions that will meet GFSI-accepted standards and ultimately FSMA requirements.

OMRON AUTOMATION AND SAFETY

With its headquarters in Kyoto, Japan, Omron Corporation is a global leader in the field of automation.

Established in 1933 and currently headed by President Yoshihito Yamada, Omron now has more than 36,000 employees, in 210 locations around the world, working to provide products and services to customers in a variety of fields, including industrial automation, electronic components industries and healthcare.

The company has head offices in Japan (Kyoto), Asia Pacific (Singapore), China (Hong Kong), Europe (Amsterdam) and U.S. (Chicago). With annual sales over $7.5 billion, Omron was ranked number 521 on Industry Week’s 2008 IW1000 World’s Largest Manufacturers.

For more information, visit www.omron247.com.

White paper prepared by Laura Studwell, the Food, Beverage & Packaging Industry Marketing Manager for Omron, a provider of automation and safety products. She has a strong background in the food and packaging industries working with associations and governing bodies throughout the Pan-Americas to drive standards for food safety and quality. Studwell is an active member of PMMI, serving on the Emerging Leaders Committee, and the Packaging Association of Canada. Prior to to joining Omron, Laura worked at Loma Systems (an ITW company), Xerox and IBM. She received her MBA from Northern Illinois University.

White paper prepared by Laura Studwell, the Food, Beverage & Packaging Industry Marketing Manager for Omron, a provider of automation and safety products. She has a strong background in the food and packaging industries working with associations and governing bodies throughout the Pan-Americas to drive standards for food safety and quality. Studwell is an active member of PMMI, serving on the Emerging Leaders Committee, and the Packaging Association of Canada. Prior to to joining Omron, Laura worked at Loma Systems (an ITW company), Xerox and IBM. She received her MBA from Northern Illinois University.

Advertisement